-

May 14 2024Your 401(k): To rollover or not to rollover?

If you’re considering rolling over your 401(k) into an IRA account, it’s important to weigh the pros and cons. Pontera has published an informative article outlining some key factors to consider when making this decision. Take a look and feel free to reach out with any questions. We’re here to help!

May 3 20248 STEPS TO MAKE A FINANCIAL PLANAre you ready to chart a course to your financial destination? We think our complimentary financial plan is the perfect first step. Learn all about the benefits described in this article from the folks at Motley Fool and give us a call when you are ready for us to prepare yours! https://www.fool.com/retirement/strategies/financial-planning

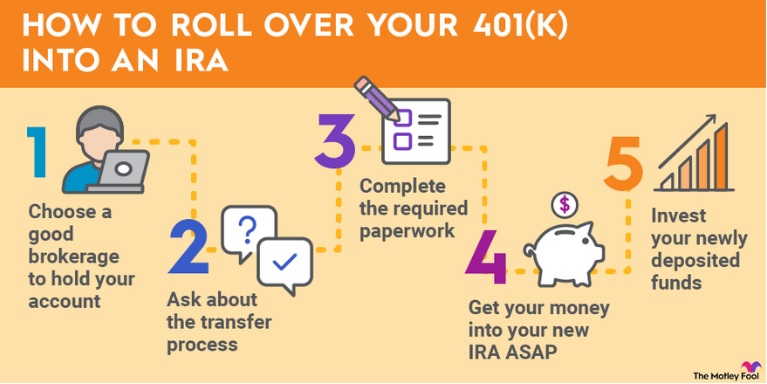

Feb 29 2024How To Roll Over Your 401(k) Into An IRAWhen it comes to your 401(k) plan, what happens when you leave your employer or the plan ends? Don’t fret! You’ve got options. Check out this informative article that outlines the pros and cons of each option. Its always a good idea to be informed so you can make the best decision for your financial Read more ➝

Aug 15 2023Thinking of a Staycation?Thinking of staying home for vacation? Vacation could just be a state of mind…and a staycation much more affordable. Here are 7 tips to a low-cost, work-free staycation…click here to read. If you are looking for more insights on how to save money, contact us for a complimentary financial checkup.

Jul 31 2023What happened to the promised recession?Real gross domestic product grew at an annualized rate of 2.4% in Q2, unemployment stands at 3.6% nationally, and wages are now growing quicker than inflation. Yes, the interest rates were just raised by a quarter point on July 26th and are projected to raise again in the foreseeable future, however, the state of the Read more ➝

Aug 21 2020Consumers prove resilient despite virusThe American consumer is proving more resilient than predicted according to the Los Angles Times. “Its a shift away from vacations. Its a shift away from dining out. Its a shift away from apparel purchases. Its those dollars that you may have invested in those things that now you’re spending on your home and in Read more ➝

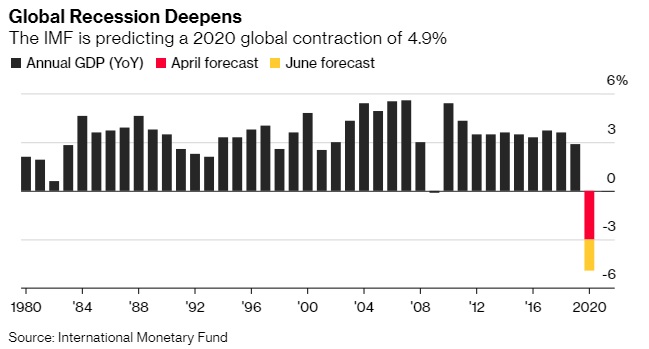

Jul 6 2020The global economy took the elevator down, it may take the stairs back up.The economy took the elevator down, but may take the stairs back up. At least that’s the opiniion of Federal Reserve Bank of Richmond President Thomas Barkin. With more than 90% of global economies set to experience a recession in 2020, it’s easy to see why he feels this way. Add to that an IMF Read more ➝

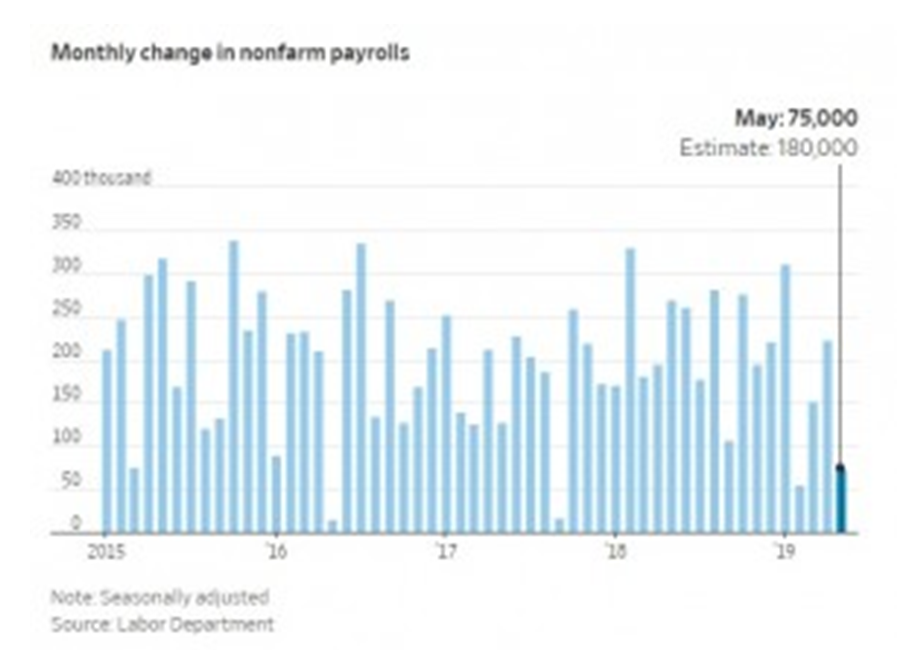

Jun 10 2019U.S Hiring SlowsOn Friday the Labor Department reported that the U.S. economy added 75,000 Jobs in May, one of the weakest monthly increases since the recession ended in mid-2009. As reported by the Wall Street Journal, “The employment figures add to other data depicting an economy that is still growing, but is losing momentum after the first Read more ➝

May 7 2019Home prices fall in Southern California for the first time in 7 years.The Los Angeles Times recently reported a decline in Southern California home prices for the first time in 7 years. This taken together with a significant drop off in the number of homes sold and a drop in national home prices, as reported by the United States Census Bureau, suggests we may be seeing a Read more ➝