Red Flags Rise on Emerging Stocks

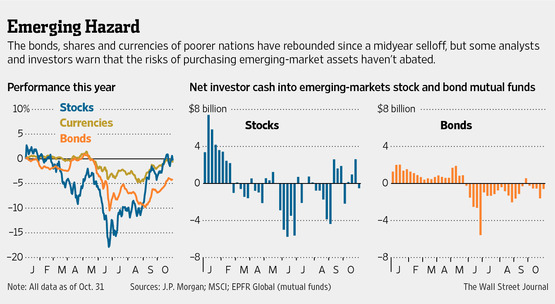

Monday’s Wall Street Journal discussed the intermediate term future for emerging markets. A growing number of analysts find the recent rebound in emerging markets troubling. Developing country equities are up 16% since June. Theeir message: Proceed at your own risk. Based on a five year forecast, U.S. small cap stocks are still a better growth story than emerging markets. There are currently three issues with emerging markets.

Monday’s Wall Street Journal discussed the intermediate term future for emerging markets. A growing number of analysts find the recent rebound in emerging markets troubling. Developing country equities are up 16% since June. Theeir message: Proceed at your own risk. Based on a five year forecast, U.S. small cap stocks are still a better growth story than emerging markets. There are currently three issues with emerging markets.

1. The global economy has cooled and so has the global export boom that fueled developing-world growth.

2. Stock gains in developing economies relied heavily on huge inflows of foreign money. This has decreased and will continue to decrease as monetary policies tighten. Few countries are ready to shift to domestic financing.

3. Rising interest rates. Recent signs of U.S. strength could push the Fed to taper its spending in December or the first months of next year. When domestic yields rise it will create pressures in the emerging markets. This may be further exacerbated by a strengthening dollar.

To read the complete article from the Wall Street Journal please CLICK HERE.