Fed’s Mixed Messages Roil Markets

The Federal Reserve’s unprecedented stimulus efforts are starting to box in the nation’s central banker.

The Federal Reserve’s unprecedented stimulus efforts are starting to box in the nation’s central banker.

Its bond purchases have helped fuel economic growth since the financial crisis. But Fed policymakers now must figure out how and when to start dialing back the support – and signal that to nervous investors – without derailing the recovery.

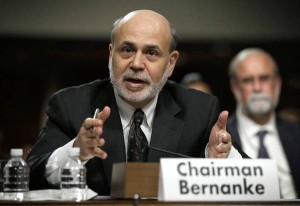

Mixed messages from the Fed on Wednesday roiled financial markets; the stock market’s sharp reaction to Fed signals underscored how much the stimulus programs have fueled this year’s rally. Bernanke seemed to speak out of both sides of his mouth as he said the central bank could start scaling back its stimulative bond buying program in the next few months, but warned against acting too quickly and harming the still fragile economy.

The Dow initially jumped more than 100 points as Bernanke began his testimony by suggesting no change in the stimulus program was imminent. The Dow then dropped sharply when he suggested the Fed soon could start tapering off the $85 billion in monthly bond purchases.

Investors and advisors are closely watching the Fed to determine when its stimulus policies, including near-zero short-term interest rates will end. Critics have complained that the Fed’s actions could fuel new asset bubbles and increase inflation.

To read more about recent Fed developments from this LA times article please CLICK HERE.